Trinity Park

2700 Rock Island Road, Irving, TX 75060

Investment Opportunity A 92-units – Apartment Community in Irving, Texas

Our Team

Our dynamic team has over 40+ years of experience. This team has gone full cycle on over 50 Multifamily assets, specializing in the Texas market.

The Market

Irving, TX is 1st best City to buy investment property, top 3 best Cities to start business in the U.S, top 25 best places to live in Texas, and top 75 Cities with the lowest Cost of Living in America.

The Property

Trinity Park Apartments is a 92-unit asset located in Irving, TX. Positioned along the highly trafficked Rock Island Road, the Property offers excellent access to several large employment centers including DFW International Airport, the Great Southwest Industrial Park, Dallas Love Field Airport, Las Colinas, and downtown Dallas. The property is built in 1984, amenity rich asset in a desirable location. Significant value-add opportunity through continued unit enhancement and other income opportunities.

COMMUNITY AMENITIES:

» Refreshing Swimming Pool

» Children’s Playground

» Multiple Picnic Areas

» Low Density Setting

» Leasing Office

» Courtyard

» Laundry Facilities

APARTMENT FEATURES:

» Full Size Washer and Dryer Hookups

» Dishwasher

» Refrigerator

» Efficient Appliances

» Balcony/Patio

» Plank Flooring

» Spacious Closets

Average current occupancy of 96.9% with 17.0% rent growth.

854 sq. ft Average Unit Size

78,600 Rentable Square Footage

Amenities include: Resident Utilities

Electricity Individually Metered, Resident’s Choice

Water/Sewer City of Irving; RUBS

Trash Republic Services; RUBS

Phone/Internet/Cable TWC; Resident Pays

Staff

Community Manager 1 Full Time

Maintenance Supervisor 1 Full Time

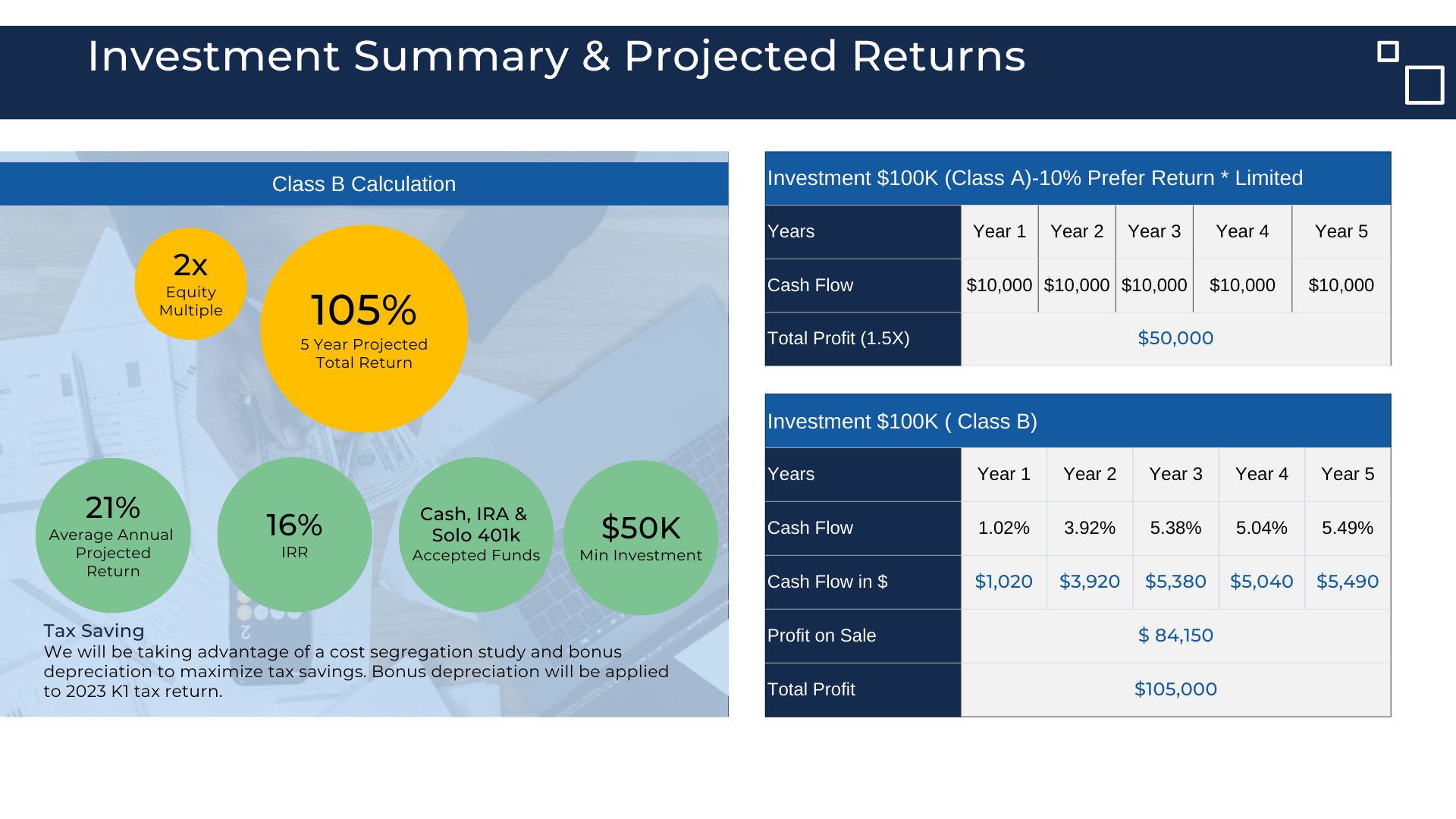

Purchase Price

$12,350,000

Loan Amount

$9,331,200

Equity Raise

$5,946,044

Minimum Investment

$50,000

Fixed Rate

10%

Projected Cash Return

5.79%

Targeted IRR

16.00%

Investment Term

5 Years

Call us at 571-455-7477 for more info

JV Capital, LLC Partner Information

Our Partnership is having 25 years’ experience in commercial real estate acquisitions, joint ventures and property management. Our team has extensive backgrounds in corporate and military leadership, Fortune 500 consulting, along with multi-family building construction.

The team is part of a larger ecosystem that has an extensive pool of active and passive investors with numerous resources to tackle large scale multi-family projects. Attached is a list of acquisitions which have a total general partnership value currently of over $200M.

Currently, the team has syndications projects and real estate holdings in 5 states, consisting of approximately 1800 units with 400 personnel under active management. Additionally, they have over 1700 units passively invested, with the majority of those being in the Dallas and Houston markets.